Suppose we talk about the sector that is always prosperous based on a nation’s economic environment in agriculture. You know very well that humans can not survive without food, and Agriculture is an evergreen sector of any country. The Indian economy is mainly based on Agriculture because agriculture is the backbone of the economy of India.

- The importance of agriculture in India:

- The cause of boom production in agriculture business in previous years

- The business of agriculture can be mainly categorized into 3 main sectors given down:

- Follow all these steps to drafting an Agribusiness business:

- Uses of Agribusiness loans:

- Sources of Agribusiness loans:

- Eligibility criteria for an Agriculture Loan:

- Documents required to get an Agriculture Loan:

- Agricultural Loan Interest Rate for Various banks in India

- FAQ

The importance of agriculture in India:

- Most Indian people’s livelihood is based on agriculture; it is almost 70% of the Indian population.

- 55 per cent of the Indian population gets employment in the agricultural sector.

- Agriculture’s contribution to Indian GDP is 15% to 16%.

Agriculture has more potential than other businesses. Nobody can live without food, you know very well. Agriculture is a vast business model; you can sell vegetables, fruits, grains, and livestock.

The cause of boom production in agriculture business in previous years

- During the last year’s boom of e-commerce, home delivery grocery markets have introduced the idea of starting farming.

- As the population increased, on the other side, demand for food production also rose.

- The need for organic food also increased in the last few years.

The business of agriculture can be mainly categorized into 3 main sectors given down:

- Agriculture production resources— seed, fertilizer, feed, machinery, tools

- Manure production for agriculture.

- Facility service — loan, storage, transportation, marketing, insurance, packaging, rental machinery, etc.

However, agribusiness also needs proper planning and knowledge to get desired results like other businesses.

Read Also: How To Apply For An E-commerce Business Loan in India

Follow all these steps to drafting an Agribusiness business:

Step1: Choose any agribusiness idea which suitable for you:

- Urban agriculture means practicing agriculture in urban areas and their surrounding regions.

- Herb, fruit, or vegetable farming

- Production of Botanical pesticide

- Organic farming

- Field crop farming

- Suppliers of fertilizers

- Dairy farming

- Poultry farming

Step 2: Keep proof of agriculture land or lease agreement.

Step 3: Do proper research and find markets that meet their requirements.

Step 4: Before starting an agriculture business, you must have ability, knowledge, and professional assistance.

Step 5: Figure out the chosen product’s short and long-term economic potential and future.

Step 6: As you focus on the type of product, then you have to find resources that help you manufacture your selected produce.

Step 7: Once you have made the final decision regarding your agribusiness sector, you will have to register the agriculture business of your choice with the chosen product name.

Step 8: A most important step at the beginning of any new business is arranging the required finances to run the business smoothly.

Uses of Agribusiness loans:

- Buying tools for farming and irrigation.

- Buying livestock.

- Purchasing of agricultural land.

- Transportation expenses.

- Marketing costs.

- Storage costs.

- Managing daily bases operations.

Sources of Agribusiness loans:

Government banks, cooperative societies, private banks, and NBFC provide agricultural business loans in India.

Eligibility criteria for an Agriculture Loan:

- Applicant must be 18 years old.

- Applicants should use the loan amount for agricultural land only.

Documents required to get an Agriculture Loan:

- ID proof – PAN card or Adhaar card or Driving license or Voter card or Ration card.

- Address proof – Ration card or Driving license or utility bill or Passport or bank statement.

- Property or land ownership proof

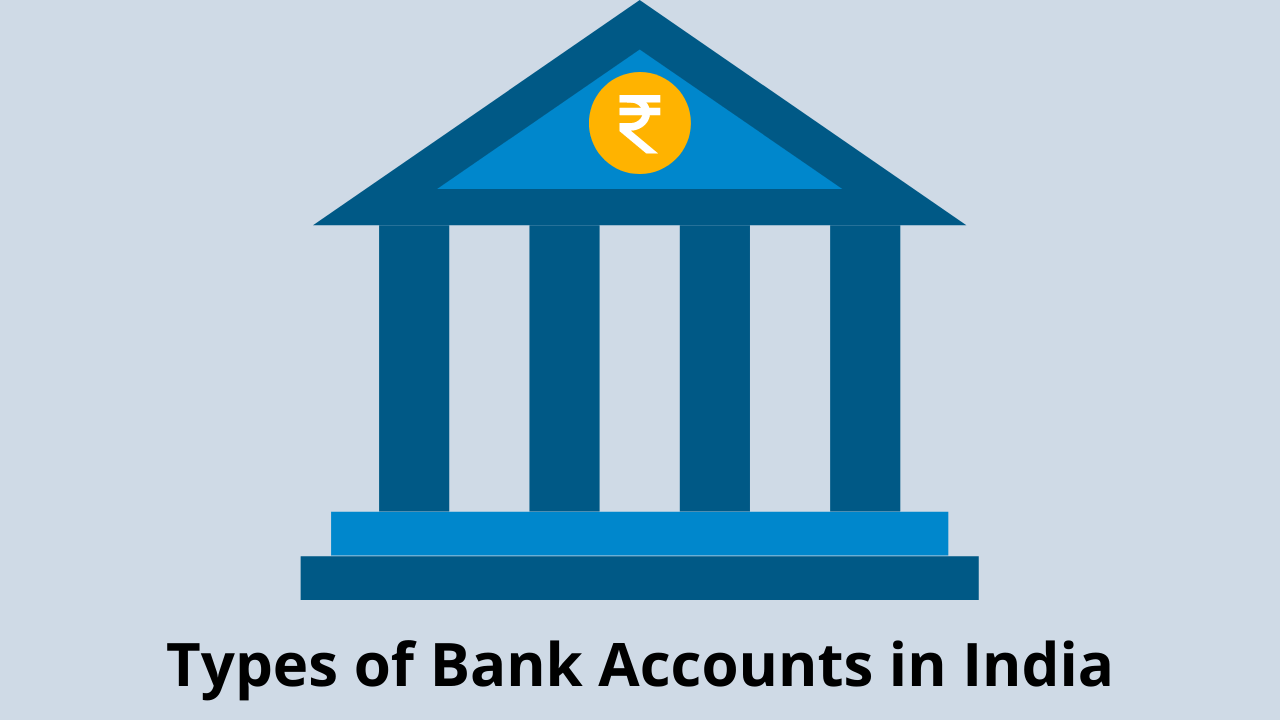

Agricultural Loan Interest Rate for Various banks in India

| Bank | Interest Rate | Processing Fee |

| SBI | 7.25% Per Annum onwards | 0% Per Annum To 1.25% Per Annum of the loan funds |

| IDBI Bank | 7% Per Annum onwards | At the discretion of the bank |

| IndusInd | 10% Per Annum onwards | 1.25% of the loan funds + GST |

| Central Bank of India | Up to 13,25% Per Annum | At the discretion of the bank |

FAQ

1. Who is eligible for an agriculture loan in India?

Ans: All farmers like small and medium tenant farmers are eligible for an agriculture loan.

2. What are the Primary AgriBusiness Categories one can invest in?

Ans: People can invest in farming tools or equipment, seed, fertilizers, irrigation tools, feed, machinery, etc. In farming commodities such as fishing business, poultry farming, and dairy farming. They support and facilitate services such as credit, marketing, rental machinery, packaging, etc.

3. What are common agribusinesses in India for which loans are required?

Ans: There are multiple categories of agriculture business such as Organic farming, Poultry farming, Fruits and Vegetables farming, Agriculture farming, Fertilizer distribution, and many more.