Are you looking for information about the Post Office Savings Account Scheme? Then you have come to the right website Banking Gyan. We will tell you step by step all information about the Savings account of the Post office :

In India, A post office savings account is also popular among Indians for savings. Anyone can open a post office savings account; 500 rupees are required to open a savings account in the post office. The individual will get a 4% p.a. interest on their savings amount. Moreover, students above ten can open this account, and one can open a single account only.

A savings account in a post office is similar to a savings account in a bank and benefits those living in rural areas. A post office has a countryside reach in comparison to the bank. Individuals get a fixed return on their investment. If Customers want to earn a guaranteed return on their money, then the post office is best for you.

A person who would like to open a post office savings account must be an Indian citizen. A minor also can open a savings account in a post office if they are above the age of ten years. Customers can also open a joint account in the post office.

How to Open Post Office Savings Account

Follow the below steps to open a post office savings account:-

- Go to your post office or India post official website to get the application form

- Fill out the application properly

- Furnish required documents and passport size photo

- Pay the required minimum deposit amount

- If a customer gets savings to account without a chequebook to deposit money of at least 50 rupees.

In a single account, customers can deposit a maximum amount of 1 lakh rupees. in a joint account, the customer can deposit a maximum of 2 lakh rupees. Anyone can open this type of account hassle-free; you just visit your post office, provide necessary documents to the clerk and open a savings account in the post office immediately.

Post Office Savings Account Charges

When opening a post office savings account, applicants must pay a few service applicable charges. These are mentioned below:

- 50 rupees for issuing duplicate chequebook

- 20 rupees for issuing a deposit per receipt

- 20 rupees (per statement) for issuing an account statement

- 50 rupees for change or cancellation of the nominee

Eligibility to Open Post Office Savings Account

Eligibility criteria for opening a post office savings account are given below:

- Minor age should be above 10 years

- Guardian can open an account on behalf of a minor

- One can hold a single account and joint account in the post office

- The company, Institution and other accounts like Security Deposit Account are not allowed

Interest Rate of Post Office Savings Accounts

The central government decides the interest rate of post office savings accounts, usually between 3 percent to 4 percent. Calculation of interest is based upon monthly balance and credit annually.

Savings accounts of post offices get a fixed interest rate on account balance through the year. Now the rate of interest is mentioned below:

Withdraw of Post Office Savings Account

In a post office savings account, account holders can withdraw cash anytime. A simple account’s minimum balance should be 50 rupees for functioning, and an account with a cheque facility 500 rupees.

Features of Post Office Savings Account

Features of a Post Office savings account are given below:-

- Individuals can close accounts anytime.

- Minor above 10 years old can operate their account

- You have to make a deposit and withdraw once in 3 years to keep the account running.

- One can open an account with cash only.

- You can decide nominee while opening the account and after opening it.

- Tax-free interest earned up to 10,000 per year.

- Customers can shift their savings account from 1 post office to another post office

- The single account holder can convert into a joint account

- Transactions can be completed via ATMs

Benefits of Post Office Savings Account

People who want to open savings accounts in the post office can access ATM and cheque facilities. Post office savings account’s benefits are given below:

Cheque facility: Cheque facility is available for a new and existing account.

ATM/Debit card: Debit card facility available in post office savings account.

Minor Accounts: Minors who are more than 10 years old can open a savings account in a post office, but parents or guardians have to give rights to operate the account on their behalf.

Portability: If you change your accommodation to another place. Then you can also shift your savings account from one post office to another branch.

Nominee: A customer can decide nominee while opening an account. And even also in an existing account

Joint Account: Customers can open a joint account. Moreover, Customers can change a single account into a joint account and vice versa.

Long period for Inactivity: To keep the account active, the customer has to deposit or withdraw once in three years. If the account holder does not require transactions in three years, then the account will be deemed inactive.

Electronic Facilities: Through electronic mode, the account holder can withdraw and deposit money in the CBS post office.

Documents Required to open a Post Office Savings Account

- Post office account opening form – ( Click here to Download )

- Post office KYC form – ( Click here to download )

- PAN Card

- Aadhaar card/Driving license/Voter card/Passport

After downloading the Application and KYC form and fill out both. Submit both forms with the required documents mentioned above and 500 rupees at your nearest post office. After finishing submission formalities, a Savings account in a post office will be opened in two business days.

Required Minimum Balance in a Post Office Savings Account Scheme

The followings are the minimum balance requirement for the post office savings account:

| Types of Account | Required Minimum Balance |

| Savings account without cheque book | ₹ 50 |

| Savings account with cheque book | ₹ 500 |

| Post Office Time Deposit Account | ₹ 200 |

| Post Office monthly income deposit account | ₹ 1,500 |

| Senior Citizen Savings Account | ₹ 1,000 |

| Public Provident Fund | ₹ 500 |

Charges of Post Office Savings Account

The followings are details of charges for a savings account:

| Post Office Savings Account Features | Charges Applicable |

| Minimum deposit requirement | ₹ 100 |

| Debit Card Charges | FREE |

| Nominee | FREE |

| Monthly Account Statement Request | FREE |

| Mobile Alert | FREE |

| UPI | ₹ 4 per transaction up to ₹ 1 lakh (mobile banking) |

| NEFT | ₹ 2.5 per transaction up to ₹ 10,000 (at the PO branch) FREE from mobile banking for amount transfers between ₹ 10,000 – ₹ 1 lakh |

| IMPS | Amount transfer up to ₹ 1 lakh – ₹ 5 per transaction (from PO branch),₹ 4 per transaction (from mobile banking) |

| Account maintenance charges yearly | ₹ 100 (applicable from the second year onwards) |

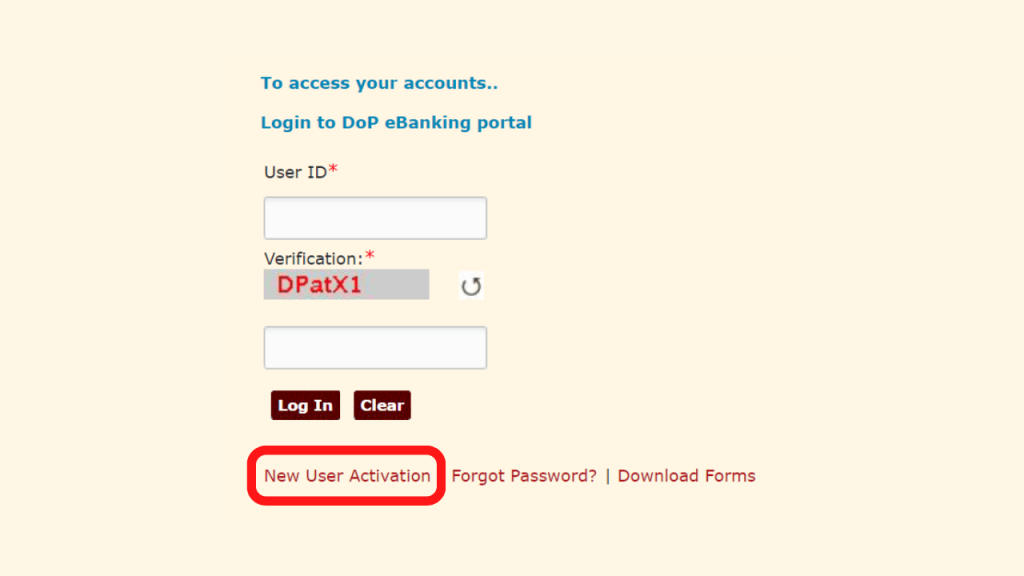

How to activate Indian Post internet banking for new users?

- Visit to eBanking Indian Post website link.

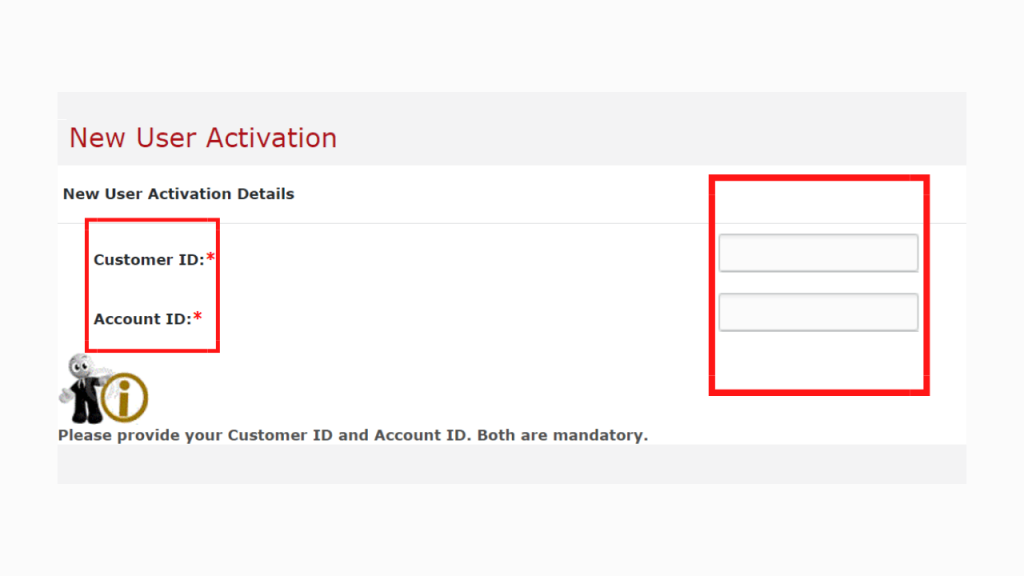

- Hit on New User Activation

- Enter your Customer ID and Account ID, printed on your passbook’s first page.

- You will get a “User ID” within 48 hours, once your activation procedure is done

eBanking Login of Post Office Savings Account

- Visit to eBanking link of India Post

- Enter your “User ID” and hit on “log in”

FAQs

1. Is money safe in the post office?

Ans: Yes, in a post office savings account, customers get a fixed guaranteed return on their investment.

2. How many accounts can be opened in a post office?

Ans: Customers can open only one account in a post office.

3. Can I shift my post office savings accounts from 1 post office to another post office?

Ans: Yes, you can transfer your account to another post office.

4. If I have a single post office savings account, Can I convert it into a joint account?

Ans: You can change your single account into a joint account.

5. What minimum number of transactions do I have to keep my account active?

Ans: You must do one transaction in three years to keep the account active.

6. How to Get the post office savings account opening form?

Ans: You can get the post office savings account opening form by clicking on India Post’s official website link.

7. How to get Post office KYC form?

Ans: You can download the post office KYC form by Visting the official website of India Post.