CVV or CVV2 is called card verification value, a type of code that helps users from online scams.

A CVV is also called CSC, CVC, or CVC2 and CID; CSC stands for card security code, CVC means card verification code, and CID is a card identification number. These codes protect card users from fraud by providing extra or second-layer protection.

Keep an eye on this article to see or learn where you can see or find CVV numbers and why CVV is most important.

How is CVV Assigned?

CVV number depends on many points, including:

- Account number

- Expiry dates

- Card network

- And other unique proprietary code

You can use a CVV number when you make online transactions.

Difference Between a CVV and a CVV2?

Keep in mind that you can see a CVV referred to as a CVV2. Both are essentially the same purpose. 2 is a second-generation CVV number created to provide extra protection to keep safe from online fraud.

Does a CVV Have 3 or 4 Digits?

CVV number is a 3-digit or 4-digit number based on the card network. Visa, Mastercard, Rupay card, and Discover card are 3-digit numbers. But on American Express cards, you can see 4 digit CVV number.

Where can see the CVV code on the Debit or Credit card

CVV 3-digit number, you can see on the back of the card; generally, it is printed next to the signature box. The card with 4 digit CVV number may print on the front of the card.

CVV vs. PIN

Remember, it is essential to know that CVV and PIN (Personal identification number) are different.

When you use your cards online to purchase something, CVV verifies authorized users or makes online transactions more secure with an extra security layer. Your card PIN helps you withdraw money from ATMs and in stores for shopping.

Some Credit cards also have PINs to get cash advances at ATMs.

What is the importance of a CVV Number and How does it save you from scams.

CVV numbers provide an additional layer of protection to save you from online fraud. CVV protects you from unauthorized transactions, so do not share your CVV number with anyone. Keep in mind not all online transactions require a CVV number yo transactions. And CVV does not protect you in credit card cases.

How to Secure Your Credit Card and CVV Number

Remember that do not share CVV and credit card numbers with anybody else; keep it private. Also, you should use the One Time Password (OTP) to protect yourself from fraud.

1. Be Aware While Saving Debit or Credit Cards details

Always check the authorized website when you save your debit or credit card details online. Always keep on OTP (Two-Factor Authentication) of your card, which will provide you with a third layer of protection. When you make an online payment, first, you must enter a card number, second CVV number, and third is an OTP number to authorized transactions. The OTP will come on the registered mobile number.

2. Purchase With Genuine Websites and Merchants

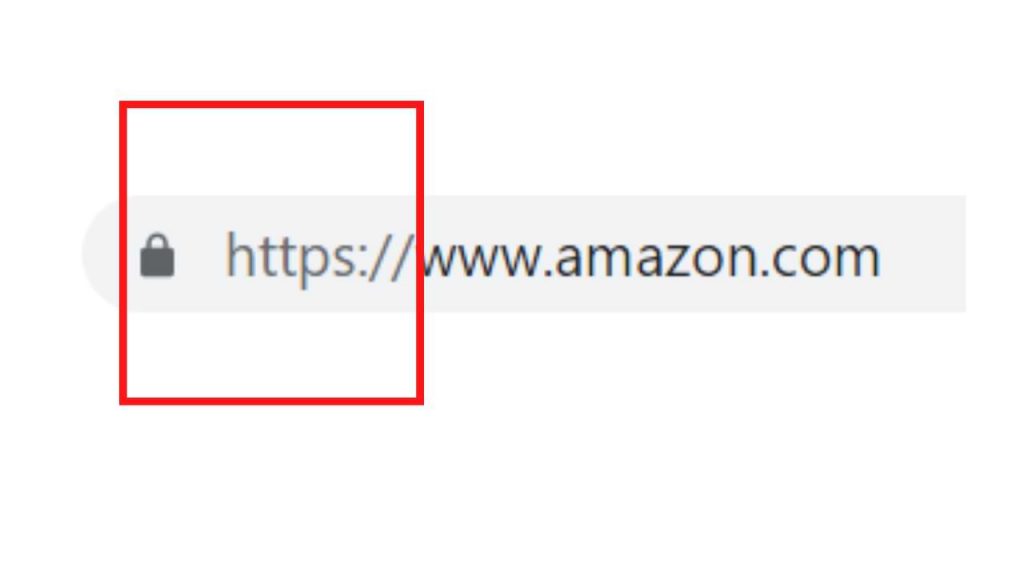

When you purchase something from any online store, always check or type the genuine website name before purchasing. Some hackers design similar-type of websites that look almost the same as genuine websites. For example, “www.abcstore.com” is the real website, and the fake website could be like “www.abc-store.com“.

And the website must be secure, which means it should start from “ HTTPS:// ” If a website begins with “HTTP:// ” do not use it for online transactions; otherwise, hackers can steal and misuse your data.

3. Be Aware of Phishing Attempts

If someone calls you to say that your card is going to expire, we will renew your card, and we need your card details. They can ask you for CVV and OTP and never share banking-related information with anyone online or on call. Scammers are masters in talking to convince people to share card deals, so never share card information.

Do not click on suspicious links. These kinds of links you can get by email or text SMS. Be aware of these types of fraud. The bank can not ask you for any card details by calling; you must visit the bank if something is wrong.

Recommends following these tips:

- Never share your banking information over the phone with anybody else.

- Do not give your credit card to anyone.

- Keep all receipts or bills to compare with your monthly statement.

FAQs

1. Full Form of CVV?

Ans:- Full Form of CVV is Card Verification Value.

2. Is it safe to give a CVV number?

Ans: Never share your CVV number with anyone.

3. Can I change my CVV number?

Ans: No, You can not change your CVV number.

4. Where I can find the CVV number?

Ans: You can find it back of the card.

5. What is 3 digit security code of my card?

Ans: CVV number is known as the Security code of the card. Which is given behind the card.

6. What is Card Verification Value?

Ans: It is known as CVV.