- Money Demand = Money Supply = Interest Rate Equilibrium

- Money Demand > Money Supply = Interest Rate ↑↑ (Shortage of Liquidity)

- Money Demand < Money Supply = Interest Rate ↓↓ (Excess of Liquidity)

Money Supply is determined by the central bank; it is a policy choice.

Money demand = F (Y,i), FY > 0, Fi <0, it is a public choice determined by public behavior, which does not change frequently.

This theory shows that the interest rate is determined by the interaction between Md and Ms. It means interest rate determination is purely a monetary phenomenon where money market equilibrium determines the interest rate.

If Md is greater than Ms, it increases the interest rate, and if there is excess Ms, it reduces the interest rate; then the equilibrium interest rate is determined where Md and Ms are equal.

According to this theory, Md is a public choice variable that is a stable function of income and interest rate. Both the transaction and precautionary demand for money are positive functions of income, and they are interest-insensitive. Similarly, the speculative demand for money is the inverse function of the interest rate.

i.e. Md = f(Y, r), fY > 0, Fr < 0

Money supply is assumed to be the policy choice variable, which is determined by the policy of the central bank and assumed to be given for the market.

![]()

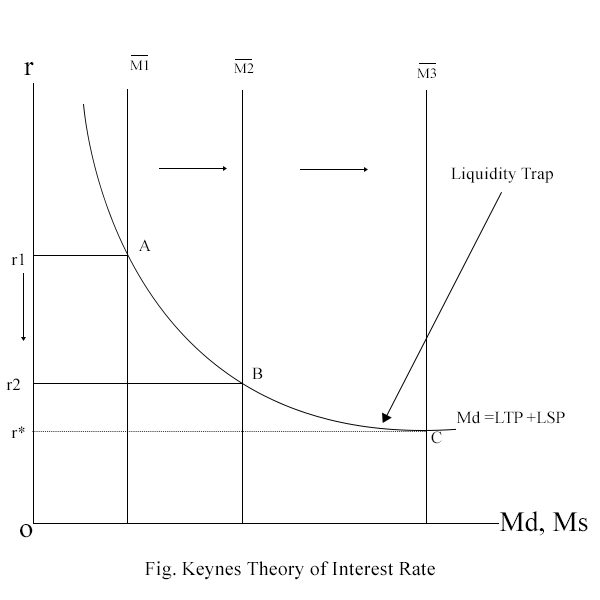

Here, if the central bank supplies M1 money, the money market is in equilibrium at A with the r1 interest rate. This means at r1 interest rate, both Md and Ms are equal.

If the central bank increases the money supply from M1 to M2, then the money market is in equilibrium at B with a lower interest rate r2. This means an increase in the money supply reduces the interest rate. So, if the central bank further increases the money supply, it will further reduce the interest rate until it falls to a critically low level, r*, at which Md is perfectly elastic, indicating a liquidity trap.

This shows that by increasing the money supply, we can reduce the interest rate, but there is a limit. If the interest rate is already at the low level where the money demand is perfectly elastic, then the economy is in a liquidity trap. In this situation, the central bank or monetary policy can not reduce the interest rate further, and whatever more money is injected into the economy, it is all trapped with the public.

Q: What is a liquidity trap? Why did monetary policy fail to revive the economy in such a trap? What could be the possible solution?

Ans – In the situation of liquidity trap, the interest rate is already at a critically low level, and money demand is perfectly elastic. So, by increasing the money supply, it is not possible to reduce the interest rate. As the interest rate remains the same at a critically low level, people hold all the money, which does not increase consumption, investment, aggregate demand, employement and growth. It means the monetary policy is not able to revive or recover the economy from such a trap.

So, the government can use the fiscal policy for the economic recovery if the economy is in a liquidity trap. To increase the aggregate demand, the government should use an expansionary fiscal policy, such as increasing government expenditure and tax reduction. To bring the money out from the people’s pockets, the government should issue high yield bond thich attracts the bonds. This helps to increase the aggregate demand by increasing investment and consumption in the economy. Such an increase in aggregate demand encourages the private sector, which further increases the invsetment and the economic recovery is possible.