Option trading is a fascinating and versatile strategy in the share market that allows investors to explore unique opportunities beyond traditional stock investments. In this comprehensive guide, we will unravel the basics of option trading, providing essential insights in simple language for beginners. From understanding the terminology to grasping key strategies, this guide aims to empower you to navigate the complex world of option trading confidently.

What is Option Trading?

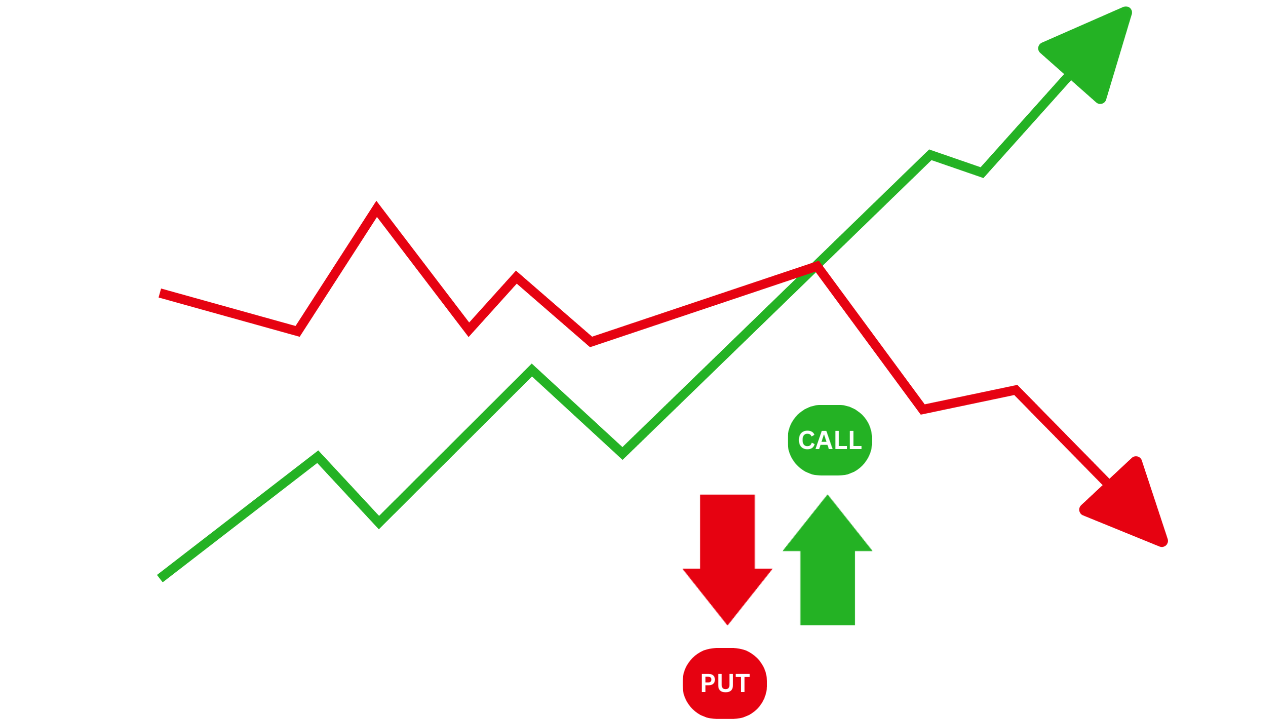

Option trading is a financial instrument that grants the buyer the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified timeframe. The asset can be stocks, commodities, or indices, and the agreed-upon price is known as the strike price. There are two types of options: call options, which give the right to buy, and put options, which give the right to sell.

Essential Option Trading Terms:

- Call Option:

A call option gives the holder the right to buy an underlying asset at the strike price before or at the expiration date. - Put Option:

A put option gives the holder the right to sell an underlying asset at the strike price before or at the expiration date. - Strike Price:

The predetermined price at which the underlying asset can be bought or sold. - Expiration Date:

The date by which the option must be exercised. Options are categorized as short-term (weekly or monthly) or long-term (quarterly or annually). - Premium:

The cost of purchasing an option. The premium is the price paid for the right to buy or sell the underlying asset. - In-the-Money (ITM):

For a call option, when the market price is above the strike price. For a put option, when the market price is below the strike price. - Out-of-the-Money (OTM):

For a call option, when the market price is below the strike price. For a put option, when the market price is above the strike price. - At-the-Money (ATM):

When the market price is equal to the strike price.

Benefits of Option Trading:

- Leverage:

Options allow traders to control a larger position with a smaller amount of capital. This leverage amplifies potential profits (and losses). - Flexibility:

Options provide flexibility to investors. They can be used for speculation, hedging, or income generation, depending on market conditions. - Risk Management:

Options enable traders to define their risk. The most a trader can lose is the premium paid for the option, regardless of the market movement. - Diversification:

Option trading provides an additional layer of diversification for investors looking to balance their portfolio.

Essential Options Trading Strategies:

- Covered Call:

An investor holds a long position in an asset and sells call options on that same asset to generate income. - Protective Put:

This strategy involves purchasing a put option to protect against potential losses in an existing stock position. - Long Straddle:

Involves buying both a call and a put option with the same strike price and expiration date. This strategy profits from significant price movements in either direction. - Iron Condor:

Combines a bear call spread and a bull put spread. It profits when the underlying asset’s price stays within a defined range. - Butterfly Spread:

Involves using three strike prices to create a position where profit and loss are limited. This strategy profits from low volatility.

Tips for Beginners in Option Trading:

- Educate Yourself:

Before diving into option trading, take the time to understand the basics. Familiarize yourself with key terms, strategies, and how options work. - Start Small:

Begin with a small investment. Options can be complex, and starting small allows you to learn without exposing yourself to significant risks. - Practice with Simulators:

Many online platforms offer options trading simulators. These virtual environments allow you to practice without risking real money. - Understand Risk:

Recognize that while options offer leverage, they also carry risks. Set realistic expectations and be aware of potential losses.

Trends in Option Trading:

- Increased Retail Participation:

Retail investors are increasingly engaging in option trading, driven by accessible platforms and educational resources. - Rise of Weekly Options:

Weekly options contracts have gained popularity, providing traders with shorter-term opportunities and flexibility. - Algorithmic and High-Frequency Trading:

The integration of technology in option trading has led to increased algorithmic and high-frequency trading, influencing market dynamics. - Focus on Implied Volatility:

Traders are paying more attention to implied volatility, as it impacts option prices. Understanding volatility trends is crucial for effective option trading.

Disadvantages of Options Trading:

- Limited Time Frame:

Options contracts have expiration dates, which means traders must accurately predict the market direction within a specified time frame. This limitation can lead to losses if the market doesn’t move as anticipated. - Complexity:

Options trading can be complex, especially for beginners. Understanding the various strategies, Greeks, and market dynamics requires a significant learning curve. - Potential for Losses:

While options offer the potential for significant returns, they also come with the risk of substantial losses. Leveraged positions can magnify the impact of market movements, resulting in swift and sizable losses. - Transaction Costs:

Options trading involves transaction costs, including premiums, commissions, and fees. Frequent trading can lead to higher transaction expenses, impacting overall profitability. - Limited Profit Potential:

Certain options strategies, particularly those involving hedging, may limit potential profits. While these strategies aim to reduce risk, they also cap the upside potential of a trade. - Market Volatility Impact:

Options prices are influenced by market volatility. Sudden and unexpected volatility changes can impact the value of options, leading to unpredictable outcomes for traders. - Assignment Risk:

For sellers of options contracts, there is always the risk of assignment. If the option is exercised, the seller must fulfill the obligation to buy or sell the underlying asset, which may not align with their trading strategy. - Overtrading Risks:

The allure of potential profits can lead to overtrading, where traders take excessive positions without proper analysis or risk management. Overtrading can increase the likelihood of losses. - Market Conditions Influence:

Options trading success is heavily influenced by market conditions. Certain strategies that work well in specific market environments may prove less effective during different phases, requiring adaptability from traders. - Psychological Challenges:

Options trading can be psychologically demanding. The potential for rapid gains and losses, coupled with the need for discipline and emotional control, can pose challenges for some traders.

Conclusion:

Option trading is a dynamic and versatile strategy that opens up new avenues for investors in the share market. By grasping the basics, understanding essential terms, exploring various strategies, and staying informed about current trends, beginners can embark on their option trading journey with confidence. Remember, education and practice are key components of success in option trading. As you navigate this exciting realm, make informed decisions, manage risks wisely, and continuously enhance your understanding of the ever-evolving options market.