Swing trading is a popular and dynamic strategy in the stock market that sits between the short-term intensity of day trading and the long-term commitment of traditional investing. In this article, we will explore the fundamentals of swing trading, provide valuable tips and strategies, and delve into current trends. Whether you’re a beginner or an experienced trader, understanding swing trading can empower you to make informed decisions in the ever-changing world of stocks.

What is Swing Trading?

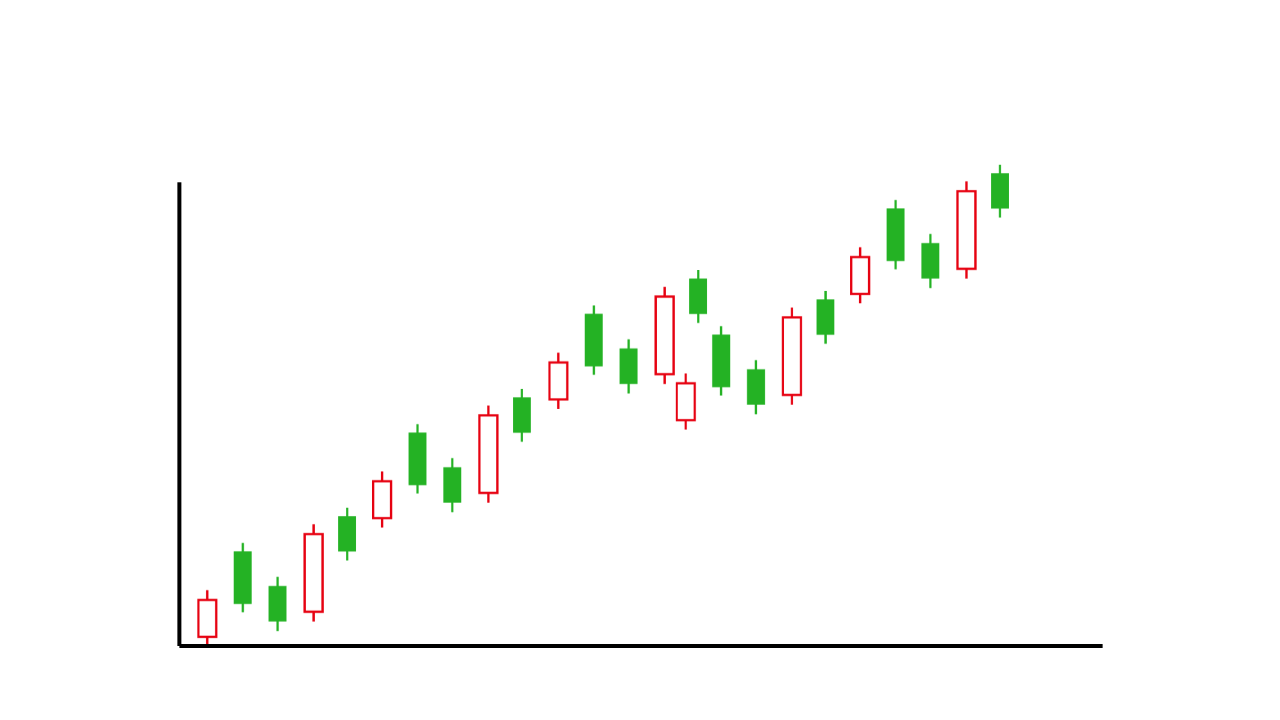

Swing trading involves capturing short to medium-term price movements within an existing trend. Unlike day trading, swing traders typically hold positions for a few days to several weeks, aiming to capitalize on price “swings” or fluctuations. This strategy requires a keen understanding of technical analysis, chart patterns, and market trends.

Key Characteristics of Swing Trading:

- Time Frame:

Swing traders operate within a time frame that is longer than day traders but shorter than traditional investors. The goal is to benefit from short to medium-term price movements. - Technical Analysis:

Technical analysis is a cornerstone of swing trading. Traders analyze price charts, patterns, and indicators to identify potential entry and exit points. - Risk Management:

Successful swing traders prioritize risk management. Setting stop-loss orders and defining risk-reward ratios are essential aspects of minimizing potential losses. - Trend Identification:

Swing traders aim to ride existing trends. Identifying the overall market trend helps in making informed decisions on when to enter or exit a trade.

Tips for Successful Swing Trading:

1. Understand Market Trends:

Before initiating any trades, it’s crucial to identify the prevailing market trend. Swing trading works best when aligned with the overall direction of the market.

2. Technical Analysis Mastery:

Develop a solid understanding of technical analysis tools such as moving averages, support and resistance levels, and chart patterns. These tools will help in making informed trading decisions.

3. Risk-Reward Ratio:

Establish clear risk-reward ratios for each trade. This ensures that potential losses are controlled, and profitable trades are optimized for maximum gains.

4. Set Realistic Goals:

Set achievable and realistic profit targets for each trade. This prevents greed-driven decision-making and helps maintain a disciplined approach.

5. Stay Informed:

Keep abreast of market news and economic indicators that may impact your trades. Awareness of external factors is crucial for anticipating potential market movements.

Strategies for Swing Trading:

1. Trend Following:

Align trades with the prevailing market trend. Buy when the market is bullish and sell when it shows signs of turning bearish.

2. Breakout Strategy:

Identify key support and resistance levels. Buy when the price breaks above resistance or sell when it breaks below support.

3. Moving Averages:

Use moving averages to identify trends and potential reversal points. Crossovers between short-term and long-term moving averages can signal entry or exit points.

4. Candlestick Patterns:

Analyze candlestick patterns to gauge market sentiment. Patterns like engulfing candles or doji can indicate potential trend reversals.

5. Support and Resistance:

Recognize and leverage support and resistance levels. Buying near support and selling near resistance can enhance the probability of successful trades.

Current Trends in Swing Trading:

1. Algorithmic Swing Trading:

The integration of algorithmic trading strategies has become more prevalent in swing trading. Automated systems analyze vast amounts of data, making quicker and more accurate trading decisions.

2. Incorporation of Artificial Intelligence:

Artificial Intelligence (AI) and machine learning algorithms are being employed to analyze market trends and identify potential swing trade opportunities.

3. Increased Use of Options:

Traders are incorporating options contracts into swing trading strategies to leverage market movements and manage risk more effectively.

4. Cryptocurrency Swing Trading:

With the rise of cryptocurrencies, swing trading has extended beyond traditional stocks. Many traders are now applying swing trading principles to digital assets.

5. Focus on ESG (Environmental, Social, and Governance) Stocks:

There is a growing trend in swing trading towards ESG stocks, reflecting an increased awareness of sustainable and socially responsible investing.

Advanced Strategies in Swing Trading:

1. Fibonacci Retracement:

Utilize Fibonacci retracement levels to identify potential reversal points. Swing traders often use these levels to determine entry or exit points based on the stock’s recent price movements.

2. Divergence Analysis:

Incorporate divergence analysis, where you compare the direction of price movements with indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) to identify potential trend reversals.

3. Earnings Season Plays:

Take advantage of volatility during earnings season. By analyzing earnings reports and making strategic trades based on the outcomes, swing traders can capitalize on short-term market reactions.

4. Sector Rotation:

Monitor sector rotations within the market. Understanding which sectors are currently in favor allows swing traders to align their trades with broader market trends.

5. Event-Driven Trading:

Stay attuned to economic events, product launches, or regulatory decisions that may impact specific stocks or sectors. Event-driven trading involves making informed decisions based on these external factors.

Challenges and Considerations:

1. Market Volatility:

The stock market can be highly volatile, and swing traders need to be prepared for sudden price fluctuations. Risk management strategies become even more critical in volatile market conditions.

2. Overtrading:

As swing traders are involved in shorter-term trades, there’s a risk of overtrading. Maintaining discipline and sticking to a well-defined trading plan can mitigate this challenge.

3. Emotional Discipline:

The emotional aspect of trading can impact decision-making. Successful swing traders cultivate emotional discipline, avoiding impulsive reactions to market movements.

4. Continuous Learning:

The stock market evolves, and successful swing traders invest time in continuous learning. Staying informed about new strategies, market trends, and technological advancements is key to sustained success.

The Future of Swing Trading:

1. Integration of Blockchain Technology:

The application of blockchain technology in financial markets may impact the transparency and security of swing trading transactions.

2. Increased Regulatory Scrutiny:

As swing trading gains popularity, regulatory bodies may implement stricter guidelines to ensure fair practices and protect retail investors.

3. Rise of Social Trading:

The integration of social trading platforms, where traders can share insights and strategies, might play a role in shaping the future of swing trading.

4. Enhanced Data Analytics:

Further advancements in data analytics and artificial intelligence could provide swing traders with more sophisticated tools for market analysis.

5. Global Market Integration:

With the ease of access to global markets, swing traders may increasingly explore opportunities beyond their local exchanges, leading to a more interconnected global trading landscape.

Risk Management Strategies for Swing Trading:

1. Position Sizing:

Employ position sizing techniques to ensure that the size of each trade is proportionate to the overall portfolio. This helps in managing risk and prevents disproportionate losses.

2. Diversification:

Diversify your swing trading portfolio across different sectors and industries to reduce risk. A well-diversified portfolio can help mitigate the impact of adverse events in a specific sector.

3. Volatility Assessment:

Evaluate the historical volatility of the stocks you are trading. This assessment aids in setting appropriate stop-loss levels and adjusting position sizes to account for the inherent volatility.

4. Adaptability to Market Conditions:

Develop strategies that are adaptable to various market conditions. Swing traders should be prepared to adjust their approach in response to changing trends, volatility levels, or macroeconomic factors.

5. Use of Options for Hedging:

Explore the use of options contracts for hedging purposes. This can help limit potential losses and protect against unexpected market movements.

Learning Resources and Communities:

1. Educational Courses:

Enroll in reputable educational courses on swing trading. Many online platforms offer comprehensive courses that cover technical analysis, risk management, and advanced strategies.

2. Books on Swing Trading:

Reading books written by experienced swing traders can provide valuable insights and practical tips. Look for titles that focus on real-world experiences and successful strategies.

3. Online Forums and Communities:

Join online forums and communities where swing traders share experiences and insights. Engaging with other traders can provide a broader perspective and access to collective knowledge.

4. Webinars and Seminars:

Attend webinars and seminars conducted by seasoned swing traders. These events often offer practical insights, case studies, and live demonstrations of successful swing trading strategies.

Incorporating Fundamental Analysis:

1. Earnings and Revenue Reports:

Pay attention to a company’s earnings and revenue reports. Positive financial indicators can be catalysts for upward stock movements, making them potential candidates for swing trades.

2. Market Sentiment:

Analyze market sentiment and investor behavior. This qualitative aspect of fundamental analysis can complement technical indicators, providing a more comprehensive view of potential trade opportunities.

3. Economic Indicators:

Keep an eye on economic indicators such as GDP growth, employment rates, and inflation. These factors can impact overall market trends and influence the success of swing trades.

4. Industry News and Developments:

Stay informed about industry-specific news and developments. External factors like regulatory changes, technological advancements, or geopolitical events can influence stock prices.

Ethical Considerations in Swing Trading:

1. Insider Trading Awareness:

Adhere strictly to ethical standards and avoid engaging in any form of insider trading. Stay informed about regulations to ensure compliance with legal and ethical norms.

2. Transparency in Reporting:

Maintain transparency in reporting. Accurate and honest representation of your trades and portfolio is essential for building trust with other traders and investors.

3. Social Responsibility:

Consider the social impact of your investments. ESG (Environmental, Social, and Governance) considerations are gaining prominence, and socially responsible investing can be integrated into swing trading strategies.

Future Technological Advancements:

1. Augmented Reality (AR) and Virtual Reality (VR) in Trading Platforms:

The integration of AR and VR technologies could enhance the visualization of market data, enabling traders to make more informed decisions.

2. Enhanced Data Analytics Tools:

Continued advancements in data analytics tools, including machine learning algorithms, may provide swing traders with even more sophisticated and accurate market analysis capabilities.

3. Blockchain for Secure Transactions:

The implementation of blockchain technology could further enhance the security and transparency of swing trading transactions, minimizing the risk of fraud.

Conclusion:

Swing trading is an exciting and versatile strategy that caters to a diverse range of traders. By understanding the core principles, implementing effective strategies, and staying abreast of current trends, traders can navigate the dynamic stock market with confidence. Whether you are a beginner or an experienced investor, mastering the art of swing trading can unlock new opportunities for financial success. Remember to continuously educate yourself, stay disciplined, and adapt your strategies to the ever-evolving landscape of the stock market.