In the dynamic landscape of the Indian stock market, the term “Sensex” is one that resonates with investors, analysts, and enthusiasts alike. It serves as a barometer, reflecting the health and performance of the Indian equity market. In this article, we will delve into the essence of Sensex, exploring its definition, components, calculation methodology, and its significance in the financial realm.

What is Sensex?

The Sensex, short for the Sensitive Index, is the benchmark index of the Bombay Stock Exchange (BSE), one of the oldest and most significant stock exchanges in India. It comprises a basket of top-performing and highly liquid stocks, representing various sectors of the Indian economy. Essentially, the Sensex is a numerical representation of the overall health and direction of the Indian stock market.

Components of Sensex:

The Sensex is not a single stock but a collection of diverse stocks that are carefully chosen based on predefined criteria. It includes stocks from different sectors, ensuring a well-rounded representation of the Indian economy. Some of the key sectors represented in the Sensex include finance, information technology, healthcare, energy, and consumer goods.

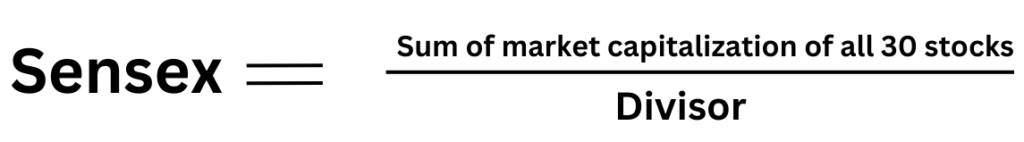

Calculation Methodology:

The calculation of the Sensex is a weighted average of the market capitalization of its constituent stocks. Market capitalization is the total market value of a company’s outstanding shares, calculated by multiplying the current stock price by the total number of outstanding shares. The formula for calculating the Sensex is:

The divisor is a unique number that helps maintain continuity in the index, considering factors like stock splits, bonus issues, and other corporate actions.

Significance of Sensex:

- Market Performance Indicator:

The Sensex is widely regarded as a key indicator of the overall performance of the Indian stock market. An upward trend in the Sensex is indicative of positive market sentiment, while a downward trend suggests a bearish market. - Investor Sentiment:

Investors closely monitor the Sensex to gauge market sentiment. A rising Sensex often boosts investor confidence, encouraging investment in equities, while a falling Sensex may trigger caution. - Benchmark for Fund Managers:

Fund managers and institutional investors use the Sensex as a benchmark to evaluate the performance of their portfolios. Beating the Sensex is a common goal for many mutual funds and investment strategies. - Economic Health Indicator:

The composition of the Sensex, spanning various sectors, allows it to reflect the broader economic health of the country. Changes in the Sensex can be influenced by economic factors, corporate performance, and global events. - Global Recognition:

The Sensex has gained global recognition as a reliable indicator of the Indian equity market. International investors often refer to the Sensex to assess the attractiveness of investing in India.

Sensex Fluctuations and Influencing Factors:

- Economic Data:

Economic indicators such as GDP growth, inflation rates, and industrial production can significantly impact the Sensex. Positive economic data tends to drive the index upward. - Corporate Earnings:

The financial performance of companies listed on the Sensex directly influences the index. Strong corporate earnings reports often lead to an increase in the Sensex. - Global Events:

Global events, including geopolitical tensions, economic crises, and changes in commodity prices, can influence the Sensex. The Indian stock market is not isolated, and external factors play a crucial role. - Interest Rates:

Changes in interest rates by the Reserve Bank of India (RBI) can impact borrowing costs and corporate profitability, thereby affecting the Sensex. - Government Policies:

Policy decisions, economic reforms, and budgetary announcements by the government can have a profound impact on investor sentiment and, consequently, the Sensex.

Historical Milestones:

The Sensex has witnessed several historical milestones, reflecting the resilience and growth of the Indian economy. Notable achievements include reaching the 1,000-point mark in 1990, the 5,000-point mark in 1999, and the 40,000-point mark in 2019. Each milestone signifies the evolution and maturation of the Indian stock market.

Conclusion:

In essence, the Sensex is not just a collection of numbers; it is a barometer that reflects the pulse of the Indian economy. Investors, analysts, and policymakers alike turn to the Sensex for insights into market trends, economic health, and investment opportunities. As India’s financial markets continue to evolve, the Sensex remains a beacon, guiding stakeholders through the complexities of the stock market and providing a snapshot of the nation’s economic vitality.